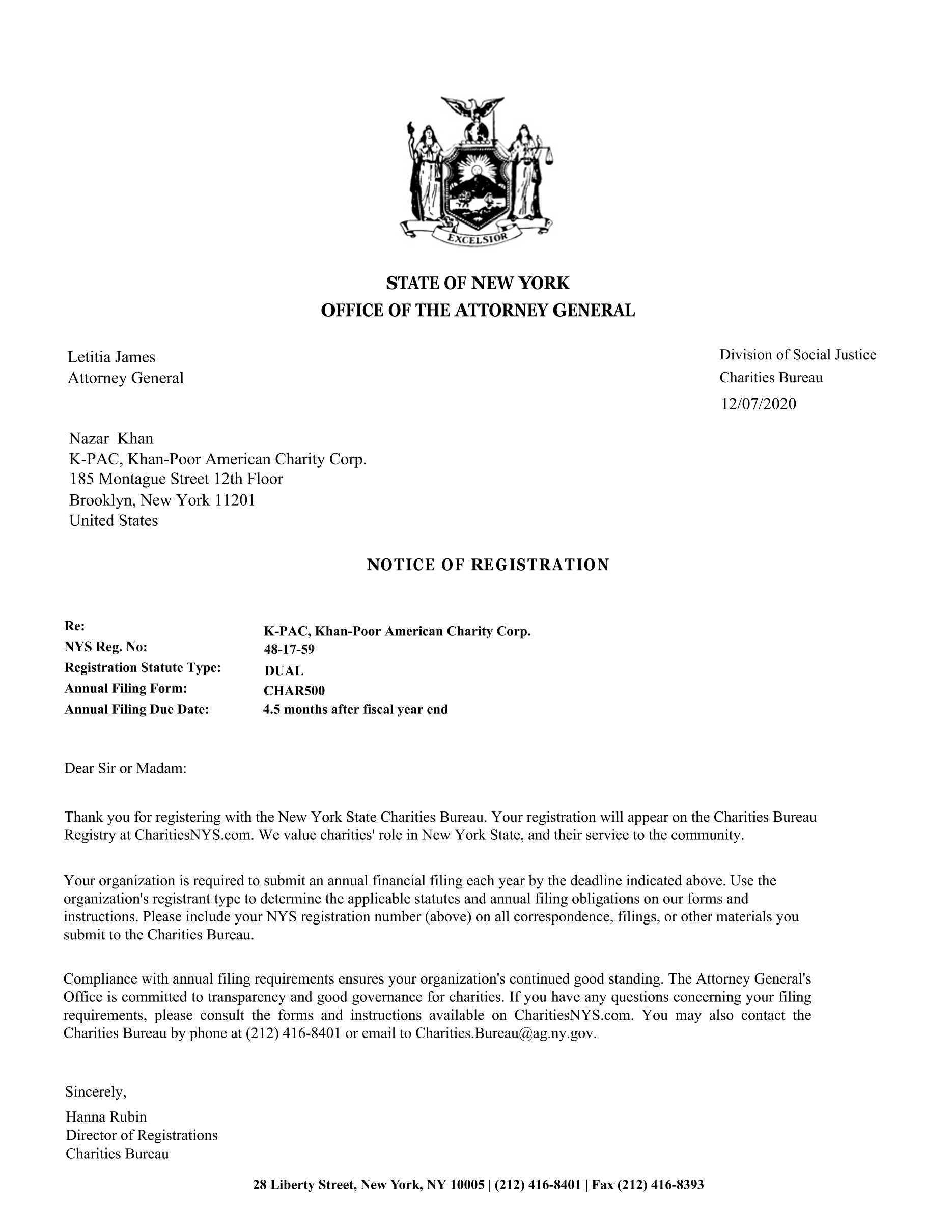

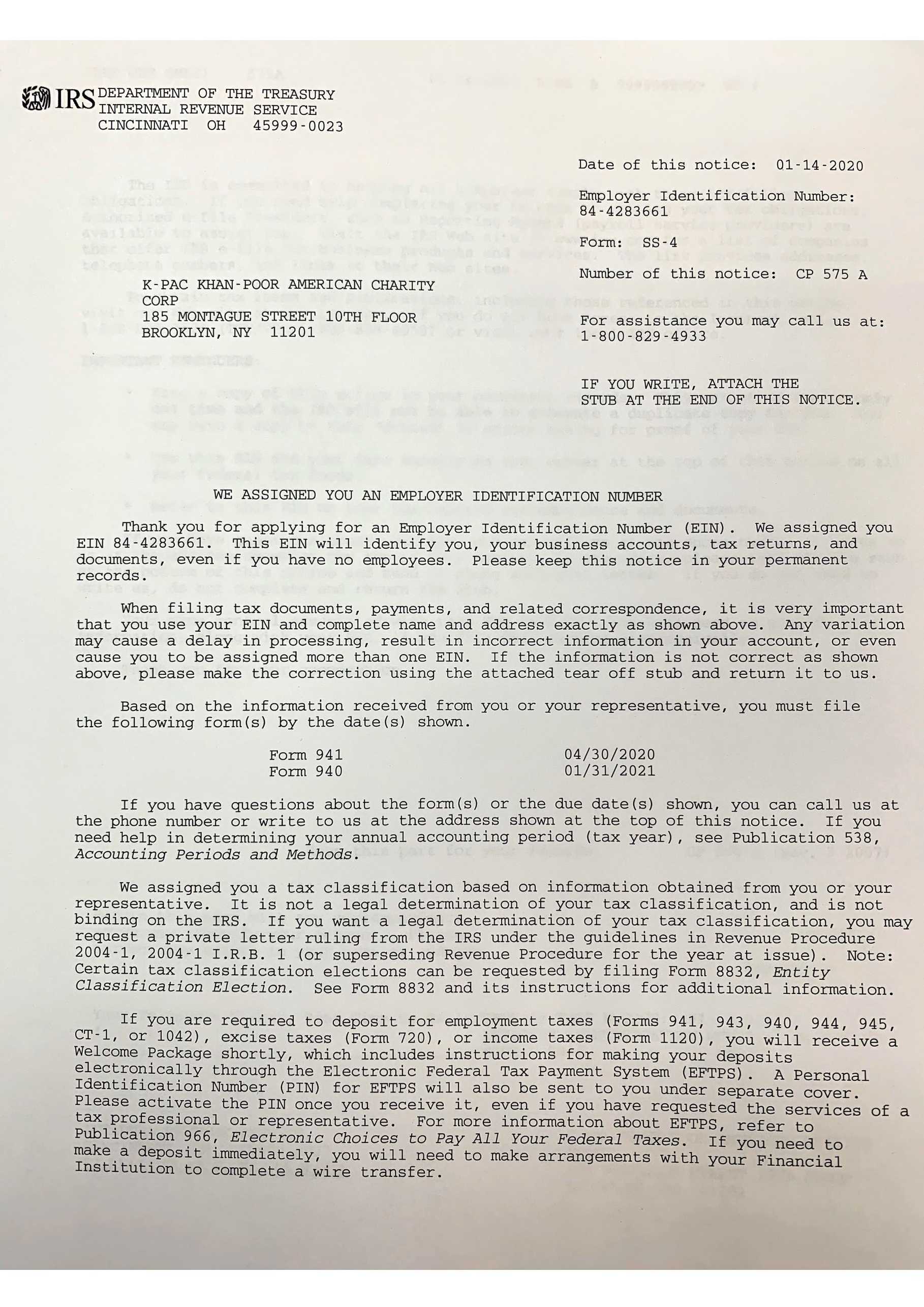

K-pac Khan-poor American Charity Corp

EIN: 84-4283661 | Brooklyn, NY, United States

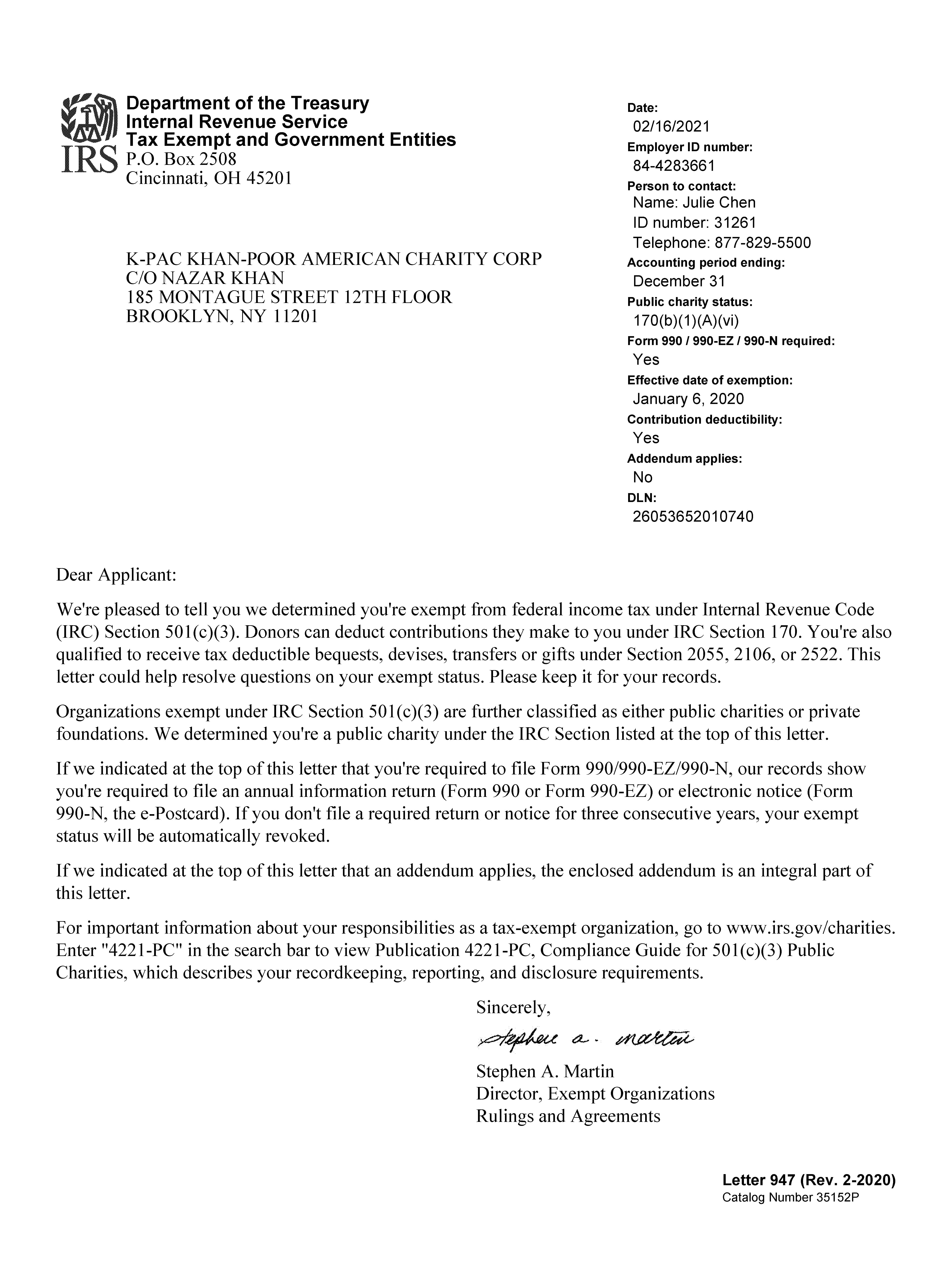

A favorable determination letter is issued by the IRS if an organization meets the requirements for tax-exempt status under the Code section the organization applied. Organizations eligible to receive tax-deductible charitable contributions. Users may rely on this list in determining deductibility of their contributions.

On Publication 78 Data List: Yes

Deductibility Code:PC

Determination Letter